The Pelosi Drug Plan: Negotiation in Name Only

KEY TAKEAWAYS

- House Democrats have introduced legislation to require the government to “negotiate” drug prices in Medicare and the private market.

- The government would levy exorbitant confiscatory taxes on drug manufacturers that do not take the price set by the government, meaning the “negotiation” is in name only.

- This approach would lead to less innovation of new treatments and cures by diminishing the incentive for drug makers to take the risks associated with bringing new drugs market.

House Speaker Nancy Pelosi and other Democrats released a bill in September that would dictate drug manufacturers’ prices, diminishing patient access and crippling future innovations. The bill proposes a program that requires the secretary of health and human services to “negotiate” prices for drugs, but it would be a negotiation in name only – it would effectively be “take it or leave it.” The bill stipulates the federal government could confiscate up to 95% of a drug manufacturer’s revenue if the producer does not agree to the government’s terms in the “negotiation.” While House committees have held hearings on the legislation in hopes of voting on the plan quickly, the resulting damage to health care through reduced innovation and access to new drugs has not been considered.

A Steep Cost to Reject Washington’s “Negotiated” Price

Negotiating terms

Speaker Pelosi’s H.R. 3, The Lower Drug Costs Now Act, would instruct the secretary of HHS to “negotiate” with manufacturers to set prices for as many as 250 drugs each year. The maximum price of each drug would be capped at 1.2 times its average price in six countries: Australia, Canada, France, Germany, Japan, and the United Kingdom. However, the final negotiated price could be far lower.

Drug manufacturers would be forced to charge these prices for both public and private payers. If the drug maker does not, it will pay a penalty of up to 95% of the previous year’s gross revenues for that drug. The penalty Democrats have chosen to use on the pharmaceutical industry for failure to comply with their price setting scheme is a confiscatory tax. This will result in a disincentive for drug makers to pursue financially risky, but necessary, research and development. Democrats argue the massive tax penalty is needed to get manufacturers to the negotiating table, but the potential financial losses may cause manufacturers to stop the innovation and production of new medicines all together.

One researcher testifying at a House Energy and Commerce Committee hearing on the bill voiced concerns that the Democrats’ approach could reduce incentives to launch new groundbreaking drugs. Manufacturers might decide they are better off pursuing generic drugs or less risky drugs, rather than trying to find cures for diseases like Alzheimer’s. Patients would have no choice but to wait longer for new therapies.

price control

Because drug makers would be in a weak negotiating position, the HHS secretary and a handful of bureaucrats essentially would be given the authority to set drug prices, based on whatever guidance they think appropriate. Their decisions would inevitably be influenced by political preferences of – and pressures on – the administration in power.

Like any business venture, drug manufacturers must consider the likelihood of making a profit when they decide to invest in developing new drugs. According to a November 2018 report by CBO, the average development period for a new drug is 12 years, with a failure rate of 90%. The next generation of innovative medicines relies on the profits of the few successful drug breakthroughs to fund research. When manufacturers do not know how a particular administration will set prices, they have even less incentive to take these financial risks.

future COSTS

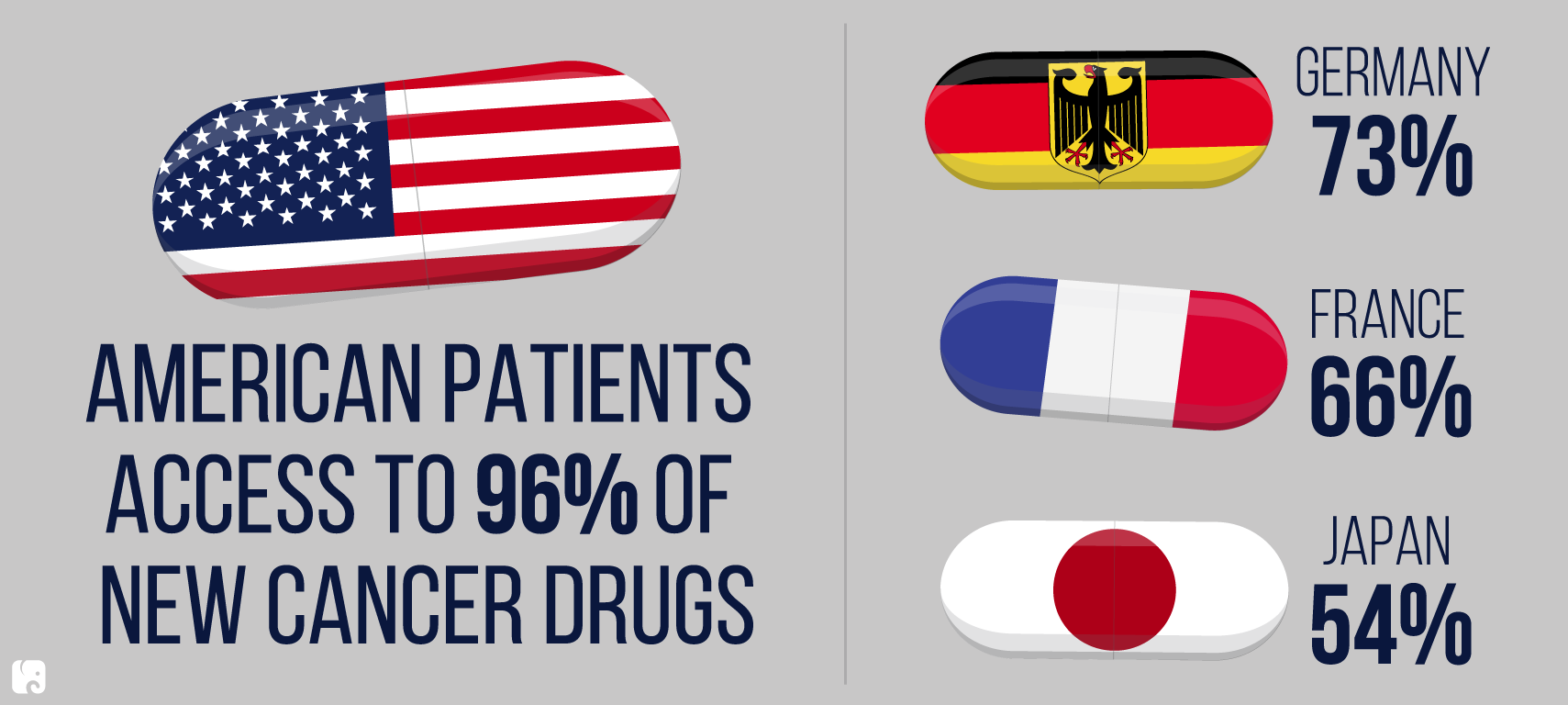

The experience of other countries, including some of the countries Democrats would use to set price caps, show the risks of this government controlled approach. According to a March report by the Galen Institute, 82 new cancer drugs became available between 2011 and 2018. Patients in the United States have access to 96% of these drugs. In Germany, patients have access to only 73% of them, in France 66%, and in Japan 54%.

2011-2018 Availability of New Cancer Drugs

The risks are too high to allow the government to dictate prices that might work in the short term to lower prescription drug costs. In the long term, it could reduce patients’ access to new drugs and stall research into potential cures for life-threatening diseases. CBO has released a preliminary estimate of the bill, estimating that it would lead to reduced spending on research and development. CBO’s partial review estimates that over the next 10 years drug makers’ earnings will drop substantially – by $500 billion to $1 trillion – resulting in a reduction of 8 to 15 new drugs never making it to market. The partial review does not account for the economic impact and damage to the overall health care system that price controls would impose. According to a February Kaiser Family Foundation poll, two-thirds of Americans oppose the idea of the government “negotiating” prices if it will lead to less research and development of new drugs.

Next Article Previous Article